The first half of 2023 has seen the US economy dispel recession fears with most companies registering two quarters of growth. This surge has been spearheaded by a strong labor market and high consumer spending. In the agricultural scene, food prices are expected to grow 5.9% (YoY) in H2 2023 and up to 2.8% (YoY) in 2024 driven by smart agricultural practice adoption. One company that is keen to take advantage of this growth is CNH Industrial N.V. (NYSE:CNHI) which has been topping revenues post-COVID-19. CNHI reported Q2 2023 EPS of $0.52 beating estimates by $0.04 while its revenue came in at $6.57 billion against Wall Street estimates of $6.44 billion.

Thesis

CNHI is solid and growing in the agricultural technology space, augmenting its revenue while paying a steady dividend despite having a considerable valuation. It made record Q2 2023 margins in agriculture and construction as well as registering high HHP tractor production levels in North America. The company’s management is working to recover lost sales in its Russian operations due to the ongoing war in Ukraine. It is also working with construction machinery/ agricultural dealers in South America to maintain the correct inventory levels in 2024 and beyond.

Solid quarter

CNH Industrial reported a solid Q2 2023 with consolidated revenues surging 8% (YoY) at $6.57 billion and a record net income of $710 million. The net income represented an increase of 46% (QoQ) from $486 million in Q1 2023 and a rise of 28.73% (YoY) from Q2 2022. Diluted EPS of $0.52 represented a rise of 30% (YoY).

CNH Industries

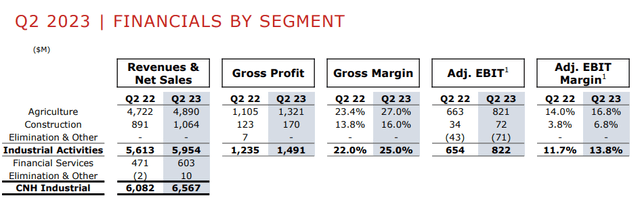

There was an increase in revenues and net sales in all CNHI segments in the quarter with the industrial activities leading the pack at $5.954 billion. The company attributed this increase to positive price realizations coupled with an offset of negative currency conversions. There were record gross and EBIT margins set in Agriculture growing 25% (YoY0) and 13.8% (YoY) respectively. For the first time, construction struck $1 billion-plus quarterly net sales underscoring continued growth, especially in the North American region. For the 6 months ended on June 30, 2023 (1H 2023) CNHI reported consolidated revenue of $11.9 billion. It was an increase of 11% (YoY) with net income in the same period up 35% (YoY) at $1.196 billion.

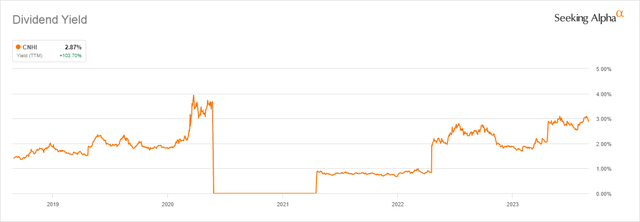

The management has consistently raised the dividend yield after 2021.

CNHI Dividend yield

At the moment, the dividend yield is at 2.87% representing an increase of 103.70% (TTM). I believe the company will continue improving this dividend as well as maintain its share buyback policy to increase shareholder returns.

CNHI leading in the agricultural revolution

CNHI introduced the New Holland T4 Electric Power tractor prototype in December 2022, the first all-electric light-utility tractor. The prototype was branded New Holland Agriculture, with the company extending the commercial model to its Case IH Brand. The company had earlier launched the “e-Source power pack generator, for electric farm implements” in its bid to continue pushing for agricultural electrification.

Fast-forward to August 2023, New Holland Agriculture (a brand of CNHI) announced the launch of the T4 electric power tractor, now in its advanced commercial state from a simple prototype. CNHI expects the T4 electric tractor to be commercially available in early 2024 with select dealers selected first in North America. The tractor is being marketed as “an ideal solution for lower horsepower field operations.” It is applicable in mixed farm settings, livestock, dairy, municipality, and greenhouse among others. Speaking about the T4 Electric Power tractor, New Holland’s Lena Bioni stated,

What New Holland is bringing to our farmers is a convergence of technology – electric propulsion, autonomous features, better performance – in the body of a utility tractor that’s setting the stage for a more efficient, sustainable, and resilient future our customers are striving for.”

With such innovations, it is no wonder that tractor sales were the highest revenue sources for CNHI in the agricultural segment followed by combines. The company reiterated that Q2 2023 had seen CNHI register the highest HHP production levels in North America since 2015. There was sustained tractor demand in the quarter with order books opened for the MY24 tractor. Additionally, it also introduced the New Straddle tractor in the quarter, described as a multifunction tractor for narrow vineyards.

North America saw the volume of large 140 HP tractors surge by 21% (YoY) against an 8% (YoY) decline for small tractors (0 to 140 HP). To supplement the decline, CNHI improved its unit performance for combines registering a rise of 27% (YoY) in North America and +32% (YoY) in the EMEA region.

I noticed that for Deere & Company (DE), retail sales for combines in North America as of Q3 2023 were up 16% (YoY) against the industry average but lower than CNHI at 27%. DE shares are down 2.52% (YTD) but up 12.52% (YoY). Due to increased food prices, the company expects its net income to range between $9.75 billion to $10 billion in the fiscal year 2023. CNHI’s management reaffirmed its previous guidance for free cash flow to range from $1.3 billion to $1.5 billion with R&D CapEx at $1.6 billion.

Improved management

I have given special attention to CNHI’s management led by its CEO Scott Wine who took over in January 2021. That same year, CNHI completed the $2.1 billion acquisition of Raven Industries in a bid to boost its precision agricultural technology business. As of December 2021, CNHI’s annual gross profit had grown 32.27% (YoY) to $4.2 billion. In Q2 2023, CNHI’s gross profit is almost half that of 2021 at $1.62 billion indicating a strong business case for the company.

With Raven Industries, CNHI has marked its space in the push for developing autonomous driving tractors. According to me, this industry is a high-growth/ high-profit margin sector that needs dedicated management. It came as no surprise that the company opened an advanced engineering center in Scottsdale, Arizona; USA just a year after Scott Wine took over CNHI. This center was to ” support the growth of Raven’s precision agriculture technology business.” I believe Scott Wine played a huge role in transforming Polaris, Inc. his former company and now he is doing the same transformation at CNHI.

Market size and company valuation

The market value for precision farming is expected to be worth $21.9 billion by 2031. It was worth $5 billion in 2021 and is forecast to grow with the global push for smart farming technological development.

CNHI’s price/earnings ratio (TTM) stands at 8.03 against the industry’s average of 18.11 representing a difference of 52.11%. The enterprise value- EV/ sales (TTM) is at 1.65 against the sector median of 1.79, a difference of 7.98%. According to me, these metrics show the stock is highly undervalued and has a strong upside potential over the next 12 months.

Risks

The ongoing Russia/ Ukraine war continues to cause supply disruptions for agricultural technology equipment. CNHI has had to close its business in Russia adversely affecting revenues in the year.

Lower food prices may affect harvest which will lead to a decline in agricultural technology equipment. For instance, corn futures are down 28.04% (YTD). It is among the most widely sown crop in the US and lower returns will affect farmer income in the long run.

Bottom line

CNH Industry reported strong fundamentals in Q2 2023 fueled by solid demand for industrial equipment such as tractors, combines, and improved construction activities in North America. I expect harvests to expand in North America, EMEA regions, and Africa, locations that will spearhead commodity demand. CNHI is advancing technology in its tractors and other equipment as it explores other revenue sources. The company has raised its R&D CapEx to $1.6 billion to augment its retail execution and pull more projects into 2024. For these reasons, I recommend a buy rating for the stock.

Read the full article here