A Quick Take On Weibo

Weibo Corporation (NASDAQ:WB) reported its Q2 2023 financial results on August 24, 2023, missing revenue but beating EPS consensus estimates.

The firm operates a large online social network in China with a variety of service offerings to users.

Management is focused on improving traffic quantity, but only “efficiently” and not at “all costs,” so traffic growth may be tepid.

I’m Neutral [Hold] WB for the near term.

Weibo Overview And Market

Beijing, PRC-based Weibo Corporation was founded in 2009 as a subsidiary of Sina Corporation to provide a micro-blogging platform and has since expanded its offerings to include a social networking platform where users can connect with each other through a variety of media.

The firm is headed by Chief Executive Officer Mr. Gaofei Wang, who has been CEO since 2014 and previously joined parent firm SINA in 2000.

The company’s primary offerings include the following:

-

Microblogging

-

Video streaming and editing

-

Weibo Wallet

-

News feeds

-

Search services.

The firm acquires customers through its social media platform, website and mobile app.

According to a 2023 market research report by Research And Markets, the Chinese market for digital advertising was estimated at $91.2 billion in 2022 and is forecasted to reach $102 billion by 2027.

This represents a forecast CAGR (Compound Annual Growth Rate) of only 2.3% from 2023 to 2027.

The main drivers for this expected growth are a growing number of internet users and increasing usage of mobile internet devices.

Also, the COVID-19 pandemic has pulled forward demand for online services and related information.

Major competitive or other industry participants include:

-

Tencent

-

Toutiao

-

Zhihu

-

Douban

-

Douyin (TikTok).

Weibo’s Recent Financial Trends

-

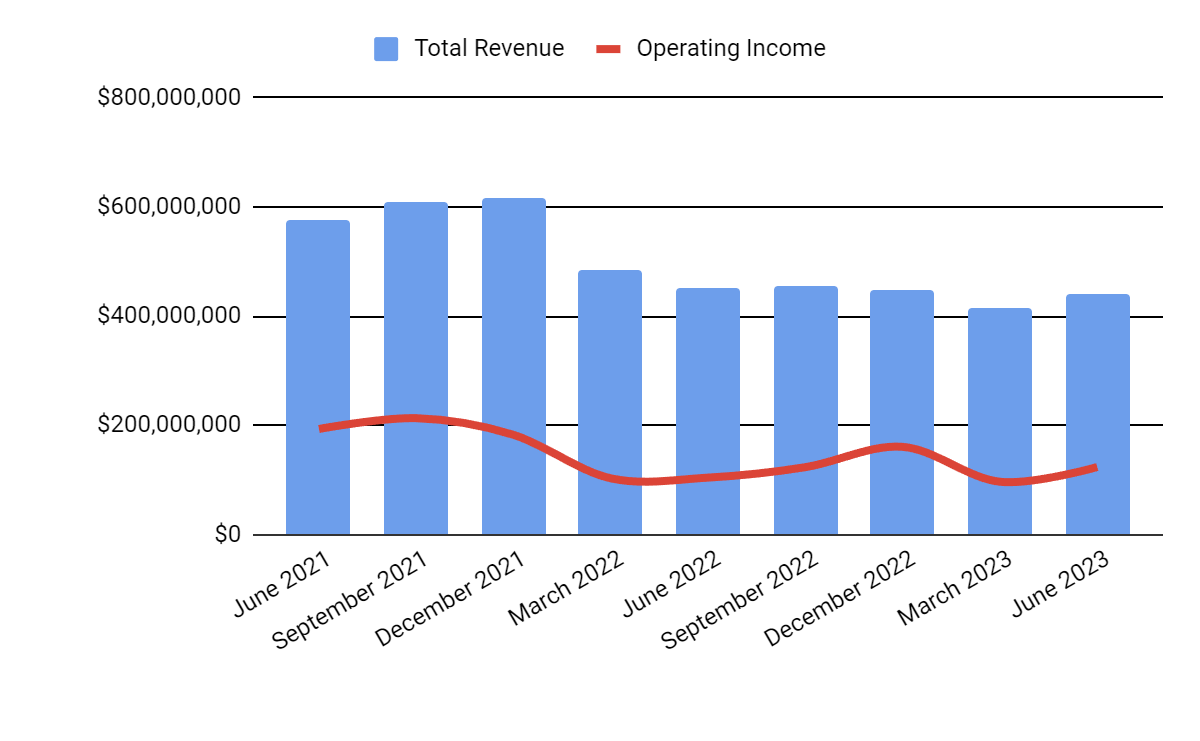

Total revenue by quarter has fallen per the chart below; Operating income by quarter has also trended lower in recent quarters.

Total Revenue and Operating Income (Seeking Alpha)

-

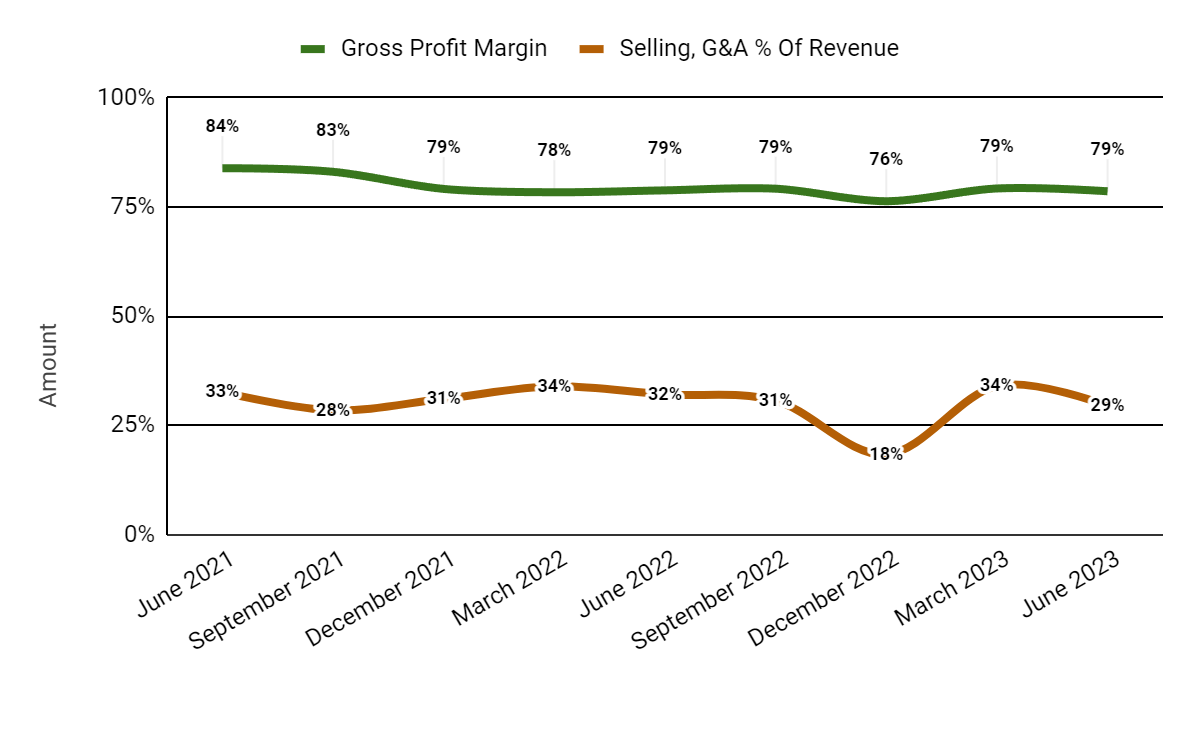

Gross profit margin by quarter has been flat to trending lower in recent quarters; Selling and G&A expenses as a percentage of total revenue by quarter have been trending lower unevenly.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

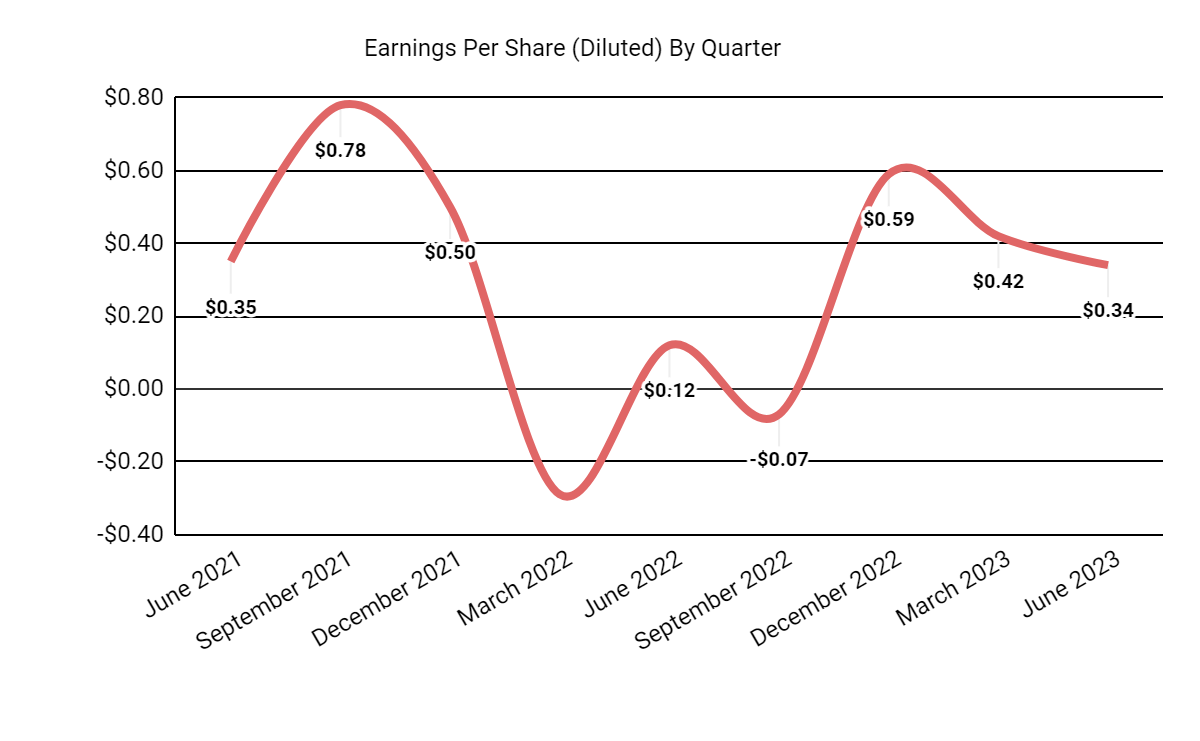

Earnings per share (Diluted) have been fairly volatile in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

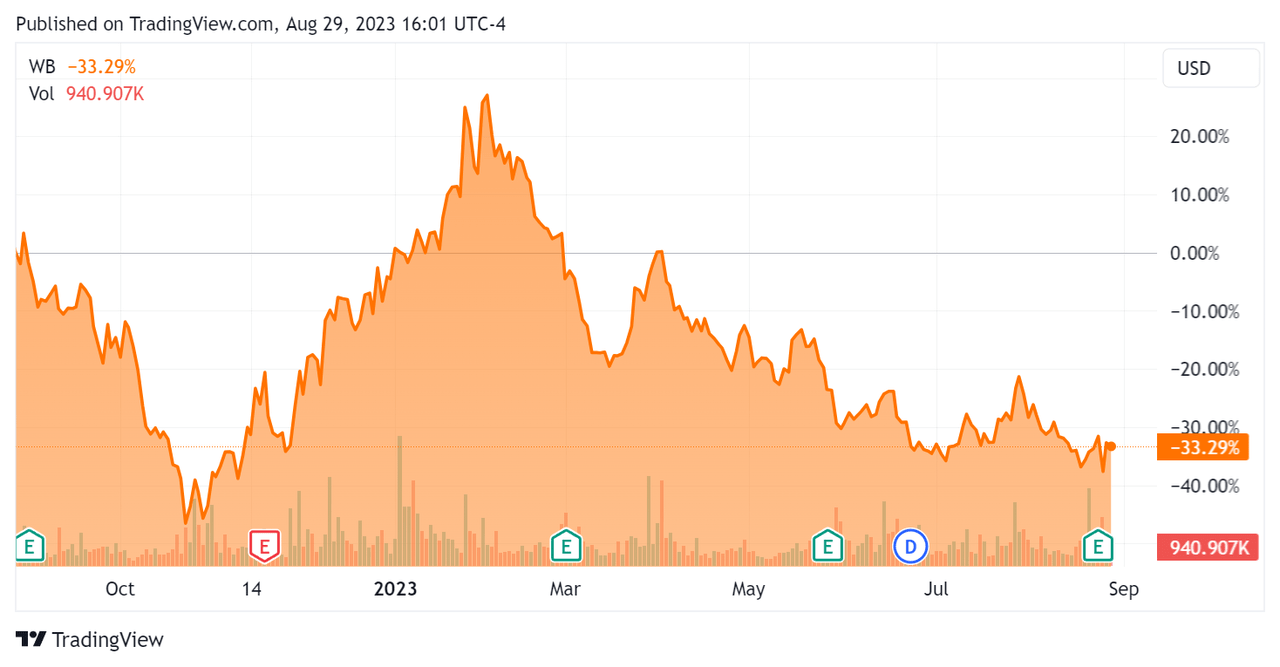

In the past 12 months, WB’s stock price has fallen a net of 33.29%, as the chart indicates below:

52-Week Stock Price Chart (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $2.83 billion in cash, equivalents and short-term investments and $2.4 billion in total debt, none of which was the current portion due within 12 months.

Valuation And Other Metrics For Weibo

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.6 |

|

Enterprise Value / EBITDA |

5.1 |

|

Price / Sales |

1.8 |

|

Revenue Growth Rate |

-18.7% |

|

Net Income Margin |

17.5% |

|

EBITDA % |

31.8% |

|

Market Capitalization |

$3,170,000,000 |

|

Enterprise Value |

$284,000,000 |

|

Operating Cash Flow |

$564,100,000 |

|

Earnings Per Share (Fully Diluted) |

$1.28 |

(Source – Seeking Alpha.)

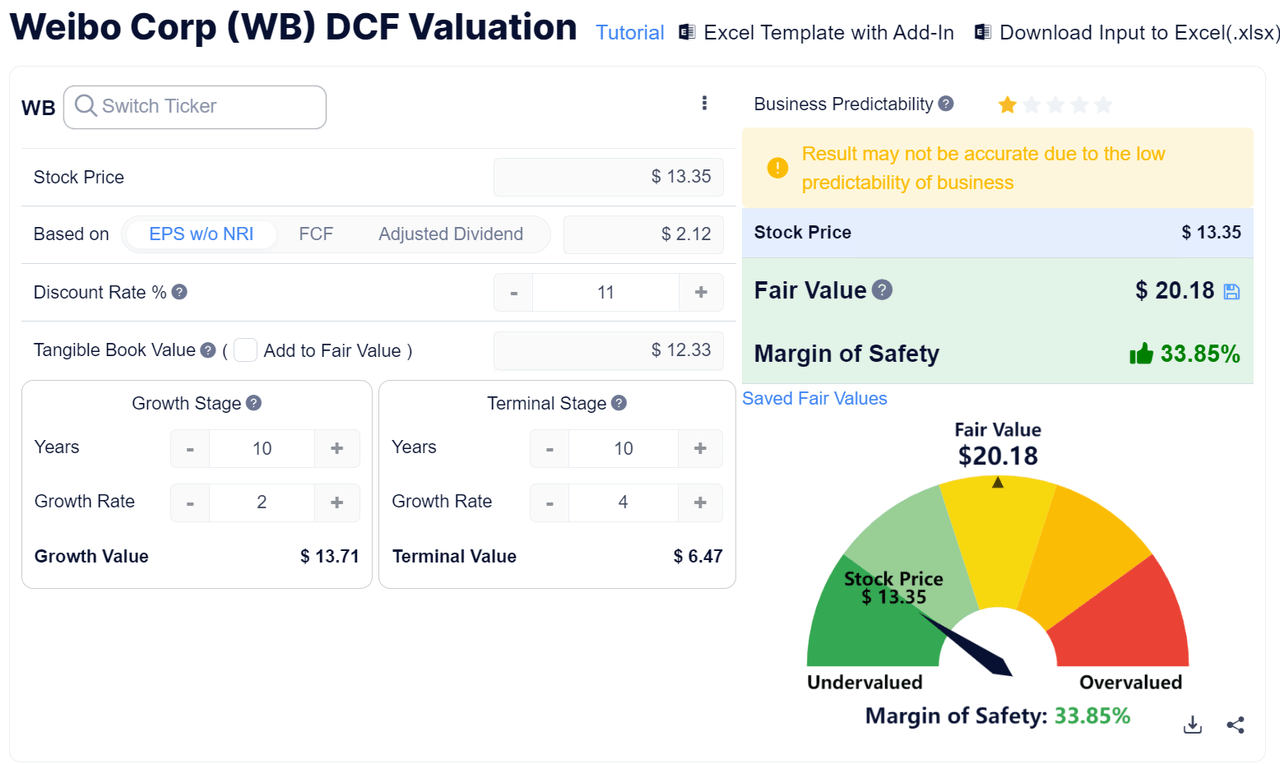

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – Weibo (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $20.18 versus the current price of $13.35, indicating they are potentially currently undervalued, given the DCF’s assumptions.

Commentary On Weibo

In its last earnings call (Source – Seeking Alpha), covering Q2 2023’s results, management highlighted its ad revenue returning to growth of 7% YoY on a constant currency basis.

Monthly Active Users (MAUs) reached 599 million, with 95% of MAUs coming from mobile devices.

Notably, with the waning of the pandemic and the removal of lockdown restrictions in China, the company has changed its focus away from pandemic topics toward “hot trends, as well as entertainment and consumption-related verticals.”

Management did not disclose or characterize the company user retention rates.

Total revenue for Q2 2023 fell by 2.2% year-over-year and gross profit margin dropped by 0.2%.

Selling and G&A expenses as a percentage of revenue dropped 2.6% YoY due to increasing operational efficiencies and operating income rose 18.6%.

The company’s financial position is reasonably strong, with more cash than debt and no current maturities on the debt.

Looking ahead, consensus revenue estimates for the full year 2023 suggest a decline of 3.1% versus 2022’s decline of 18.64% against 2021.

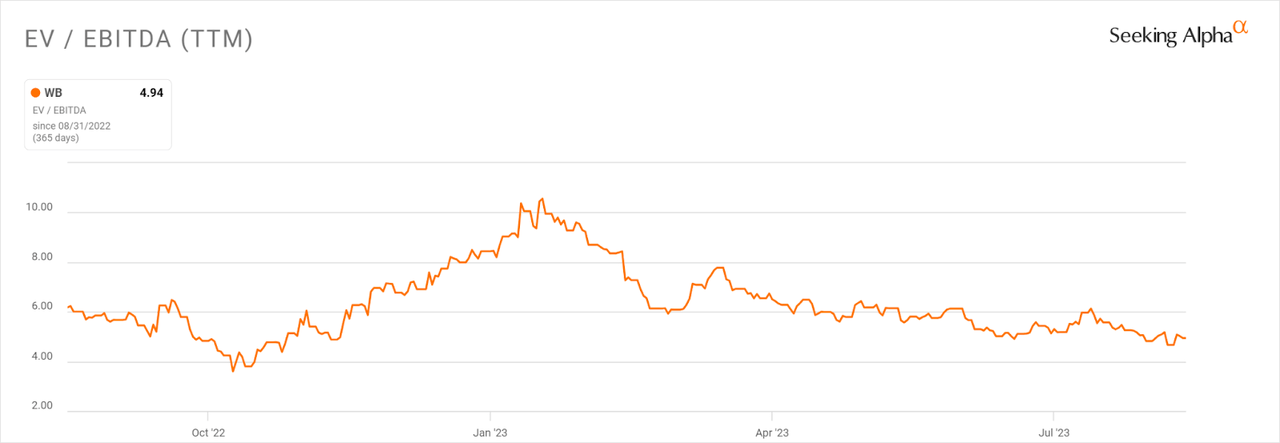

Regarding valuation, in the past twelve months, the firm’s EV/EBITDA valuation multiple has dropped a net of 16.6%, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include continued growth in advertising demand as the Chinese economy moves on from the pandemic.

However, an important vertical for the company, handsets, has shown a 10% decline in sales in the first half, indicating that certain verticals may be challenged in the quarters ahead.

Additionally, management appears focused on recovering traffic “efficiently,” which is code for not at all costs.

So, while we may see Weibo Corporation produce some growth figures throughout 2023, and its revenue decline will likely be much less than that of 2022’s results, it may not be enough to produce an upside catalyst for the stock.

As such, I’m Neutral [Hold] on WB for the near term and until we see further data on the overall direction of the Chinese economy and consumer confidence there.

Read the full article here